Why Is Your Credit Score So Important?

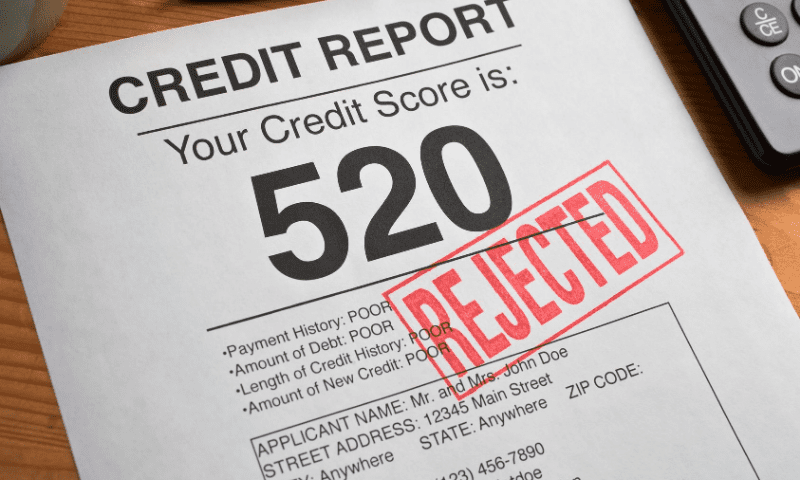

Your credit score is a reflection of how well you are able to pay back what you borrow.

A mortgage lender wants to see that you are capable of paying back the money you borrow and that you handle your finances responsibly.

Many mortgage lenders will use your credit score to help determine:

- Whether to lend you money;

- How much to lend you;

- How much interest to charge.

Here are our 7 top tips to help you improve your credit score!

7 Ways To Improve Your Credit Score

TIP #1 – Obtain a copy of your credit report

Many clients we speak to do not know how to check their credit score and obtain a copy of their credit report.

There are several different credit reference agencies who supply your financial data to mortgage lenders such as Equifax, Experian, Transunion but not every credit reference agency reports the information in the same way!

By obtaining a copy of your credit report, you will:

- Find out what your current credit score is.

- See the people you are financially linked to.

- See the history of all your financial accounts (e.g. loans, credit cards, bank accounts) including any missed or late payments in the last 6 years that may affect your mortgage application.

- Be able to check for any mistakes that have been reported that may stop you getting the mortgage you want.

It is important to obtain a copy of your full report and check it thoroughly to make sure you agree with the information on there. We have previously worked with clients who were not aware that they had defaults registered against them or missed payments recorded until we checked their credit reports.

If you want to check your credit score and credit report and not sure how to do this, drop us a message.

TIP #2 – Pay your bills in full and on time!

Missing payments or making payments late will affect your credit score in a negative way. By missing payments, it indicates that you are not able to manage your finances and pay your bills on time which doesn’t look great to a mortgage lender who is considering whether to approve your mortgage application.

TIP #3 – Use credit cards responsibly

Using a credit card little and often and repaying back the balance in full not only stops you from paying unnecessary interest but also helps demonstrate your ability to repay money you borrow.

Providing you make sure you don’t miss any payments, over time this will help improve your credit score.

However, be mindful that the following can impact your credit score:

- Withdrawing cash from your credit card.

- Spending close to your credit limit on your credit card.

- Making payments late.

TIP #4 – Don’t keep unused credit cards and store cards

If you have accounts open that you no longer use, consider closing the accounts.

Remember to close the accounts before cutting up the cards though!

Tip #5 – Make sure you are on the Voter’s Roll!

By being on the voter’s roll (also known as the electoral register), it shows security and stability to mortgage lenders so make sure you are registered on the electoral roll.

If you aren’t already registered, you can register online at Gov.UK by clicking here

Tip #6 – Avoid making multiple applications

Applications for any type of finance usually involves a credit search and the search will be captured on your credit file. Too many credit searches in a short period of time can adversely impact your score. Make sure you think carefully and take advice before applying for any finance, including mortgages.

By speaking to a professional whole of market mortgage broker like The Mortgage Pride, you will be able to confirm that you are eligible for the finance before any application is made, protecting you against any unnecessary credit checks.

Tip #7 – Patience is key!

It can take time for your credit score to improve. Credit reference agencies don’t update their information daily, meaning that your information can take a while to be updated.

If you have any questions about your credit score or would like to benefit from our expert mortgage advice, please contact us on 01782 450050 or hello@themortgagepride.co.uk.

*Your mortgage may be repossessed if you do not keep up repayments on your mortgage.